bitcoin

-

Cryptocurrencies

What Cryptocurrencies can you invest in and trade? Since the launch of Bitcoin in early 2009 there have been thousands of other digital tokens based on blockchain technology. They are usually the means of exchange built into a project aimed at providing some real world use such as validating transactions and provide security. Some have become major currencies such as Ripple (XRP), Ethereum (ETH) and Litecoin (LTC), while many other projects, and their associated coin, have failed to obtain traction.

Two of the best websites to view a complete list of Cryptocurrencies ordered by market cap and trading volume are coincap.io and CoinMarketCap. Both sites provide links to the associated website of the coins project so more detailed information can be found to help with assessing the potential of the coin and the project.

Some other good sources of review and information about Cryptocurrency projects and the coins can be found at:

Bitcoin

Bitcoin is the first and most well known of the cryptocurrencies, and many believe it will stay at the forefront of value, being compared to a digital 'gold'. It currently has over 50% of the crypto market capitalisation and dominates the overall market.

Stable Coins

Coins such as Tether (USDT) are known as stable coins because they are backed by a FIAT currency (USD) on a one to one basis and are thus tied to that currency. On exchanges that don't offer FIAT trading pairs (USD, EUR, GBP etc) then a stable coin provides that facility.

Alt Coins

Everything else apart from Bitcoin and the stable coins is known as an alt coin or altcoin (alternative coin). There are many thousands, some of very dubious origin or use, but the major alts such as Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH), EOS (EOS) and Binance Coin (BNB) have huge market caps in the billions of USD and can be considered as worthwhile as Bitcoin for long term investment or trading.

Cryptocurrency News & Opinion

There is no shortage of opinion, review, analysis and news reporting in the world of crypto. Everyone has an opinion, and it's usually different to the next person. One will write convincingly, using technical analysis and market data, that Bitcoin is about to crash into the crypto abyss, while another will use the same data to argue it is about to moon past $20k. As with all matters it's best to read widely and then form your own opinion.

An excellent place to start with the latest crypto news is actually the charting website TadingView. Once a trading pair is selected. BTCUSD for example, then the right hand bar has a Headlines section that is updated regularly throughout the day. This has links to the latest news articles being published and is a good place to find publications on crypto with a wide range of topics. Some are listed below.

-

Storing Crypto

Now you have some Cryptocurrency! Where can you keep it safe, yet accessible? Holding money in a cryptocurrency is not quite the same as keeping your money in a bank account. With crypto there are no banks!

Essentially all your money is now a very long number that represents an address known as a wallet. This wallet may be on an exchange or other trading platform, as a software wallet online, on a PC or even a mobile application. Another option is a hardware based wallet, similar to a pen drive, that is not permanently connected to the internet, also known as a cold wallet or cold storage. The wallet stores the private and public keys that are needed to interact with the blockchain in which your cryptocurrency is stored.

It is important to note that whatever wallet you are using it does not physically store your Bitcoin, or other cryptocurrency. The wallet gives you access to the blockchain where it is stored as transactions, so if you are using a PC based software wallet and your hard drive crashes, or you lose a hardware wallet like the Ledger Nano, it does not mean you have lost the crypto. There will be a recovery phrase, also known as the seed phrase, (usually a series of unrelated words) that can be used to restore your access to the crypto stored on the blockchain. Along with the actual public and private keys, the recovery phrase is the most important information, so back it up securely, and write it down somewhere safe. If you lose it then you may lose all your funds, and if anyone else gets hols of it then they can access your funds.

It is reported that there are almost 32 million Bitcoin wallets current at the moment. One user can of course have any number of wallets associated or owned by them, through exchanges, software wallets, any applications that use Bitcoin, or as hardware wallets.

A good place to start assessing the range of cryptocurrency wallets available is bitcoin.org where there is a select list of wallets primarily for Bitcoin. See the list at Choose your Bitcoin wallet. Note that this isn't the official Bitcoin website - there is none! Bitcoin, its blockchain and network are not owned by anyone one individual, business, government or other entity.

A term that may be used to describe Bitcoin wallets is SegWit, which in short is the latest technology to make transactions faster, and reduces the fees. So SegWit is something that you should look for in a wallet.

Online Crypto Storage

Online cryptocurrency wallets are those based on a remote server or cloud, that are accessible via the internet using a web browser. They store your private keys and are hosted by a third party. While being very convenient they are less secure than other wallets. They are ideal for storing cryptocurrency that you are intending to use to make purchases on a day to day basis, but not as a store for large amounts.

PC Software Crypto Storage

A software wallet on a PC, Mac, or laptop is more secure than online storage, but is still vulnerable if your computer is hacked. Be careful not to store your private keys or recovery phrase in an easily readable format on the computer if it is connected to the internet.

Mobile App Crypto Storage

Mobile based cryptocurrency wallets are useful for easy access to crypto funds, but may lack some of the features of PC based software wallets. Some wallet apps, such as Button Wallet, are integrating the purchase of crypto directly into the app.

Hardware Crypto Storage

Hardware based crypto wallets, such as the Ledger Nano and Trezor, store your private keys on a small device that can be kept disconnected from the internet until a transfer of funds needs to be made. This is the most secure form of wallet.

One of the best hardware storage devices for cryptocurrency is the Ledger Nano

range.

-

Trading Cryptocurrency

How to trade cryptocurrency? Simply put it is the same as any asset in that the trader will want to buy low and sell at a higher price. Sounds simple enough in the world of cryptocurrencies, and where prices can go up rapidly, easily 10-20% in minutes, or 50-100% over a day or two, it should be easy to simply buy some cryptocurrency and wait a while, selling once it makes a substantial gain. But crypto can also go down rapidly by the same amounts, and stay at a lower value for a long time, so it is also extremely easy to lose money!

Trading Cryptocurrency is not for the inexperienced, or novice trader in financial markets. Nor is it for those not willing to take risks with their money and to spend the time learning how to manage trades so as to reduce that risk. It is good advice, widely found in all the literature on trading, that you should never risk more than you can afford to lose. Trading isn't gambling, but it can take a lot of time and effort to learn how to manage the risks and preserve the trading capital, and while learning it is very likely you will lose some money, and hopefully make some. Learning to trade crypto is about discipline, risk and money management, as much as predicting the next price move.

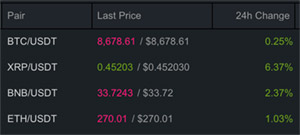

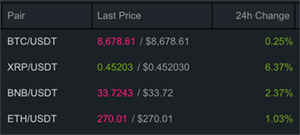

Cryptocurrency Trading Pairs

Whenever a pair of cryptocurrencies is offered for trading on an exchange the Ticker Symbols are shown in a similar form, for Bitcoin to buy Ripple, to BTCXRP, or BTC-XRP, or BTC_XRP. The symbol to the left is called the Quote currency, which is what is used to purchase, and the price quoted of, the Base currency to the right side. So with BTC-XRP it is the price of Ripple in Bitcoin that is quoted. If the trading pair is USDT-XRP then the price is quoted and traded with USDT (Tether).

Whenever a pair of cryptocurrencies is offered for trading on an exchange the Ticker Symbols are shown in a similar form, for Bitcoin to buy Ripple, to BTCXRP, or BTC-XRP, or BTC_XRP. The symbol to the left is called the Quote currency, which is what is used to purchase, and the price quoted of, the Base currency to the right side. So with BTC-XRP it is the price of Ripple in Bitcoin that is quoted. If the trading pair is USDT-XRP then the price is quoted and traded with USDT (Tether).Crypto Charts

Before deciding to purchase a particular cryptocurrency it is important to understand the price as it relates to the historical data, and then to access if the current time is good to buy, or if the price is moving down and waiting a while may be advantageous. Simply buying a cryptocurrency from a consumer website, app or wallet that offers instant purchases for FIAT using a credit card may seem like an easy method, and it may be for some, but it will be difficult to assess how the price being offered relates to the actual price available direct on an exchange, or how the price reflects historical price fluctuations.

Most good places to buy crypto will incorporate a chart of the cryptocurrency historical data, available over different time frames, and up to date within the last minute. Charts are also available on dedicated websites such as TradingView (one of the most popular and widely used), Coinigy or Cryptowatch, via exchanges such as Binance, or in a range of Mobile Apps such as TabTrader.

Cryptocurrency Chart - Bitcoin Transferring Cryptocurrency

Once bought the Cryptocurrency that will be used to trade with will most likely have to be transferred to an exchange for trading, such as Binance, unless it stays on the exchange on which it was bought with FIAT, such as Coinbase. With Coinbase it is possible to trade directly with FIAT, such as US Dollars (USD) or Euros (EUR), but most exchanges will only allow trading with Cryptocurrency with Bitcoin being the most used, followed by Ethereum (ETH), stable coins such as Tether (USDT) or alt coins.

It is therefore very likely that transfers of Cryptocurrency for trading will have to be made. The process should be documented fully on the exchange being used, and will include a wallet address (an example would be in the form of 3G5LytFvbAzX7QYAsRa3uGCTywYi0Z7bfv), that must be carefully copied as mistakes in sending can not be reversed! It may be advisable to send a small test transaction first to ensure that everything has been copied and configured correctly.

Technical Analysis (TA)

Technical analysis is the term used to describe the pursuit of using historical price data, shown in charts, to assess optimum entry and exit points for buying and selling Cryptocurrency (and many other assets such as stocks, shares and FOREX). It's not necessarily predicting exact price movements, but the most likely moves in price so that the trader can plan ahead depending on the actual move being made, be that a bounce off support, a break out above resistance, or a move though support down to the next support level. In this way the trader can assess potential risk to reward ratios, and wait for confirmation of the price move before buying. It is of course very much more complicated that that, and whole books and online courses are dedicated to the subject - far more than can be covered here.

One of the most important concepts is that of resistance and support lines where the price has historically responded to a certain level by hitting it and rising above regularly, or reaching it and dropping back. These often form very noticeable patterns that can be seen on multiple time scales, from minutes to weeks, and can be useful in predicting if the price will move to a certain level then change direction, or if it breaks the level then where it might move to, and the extent of that move.